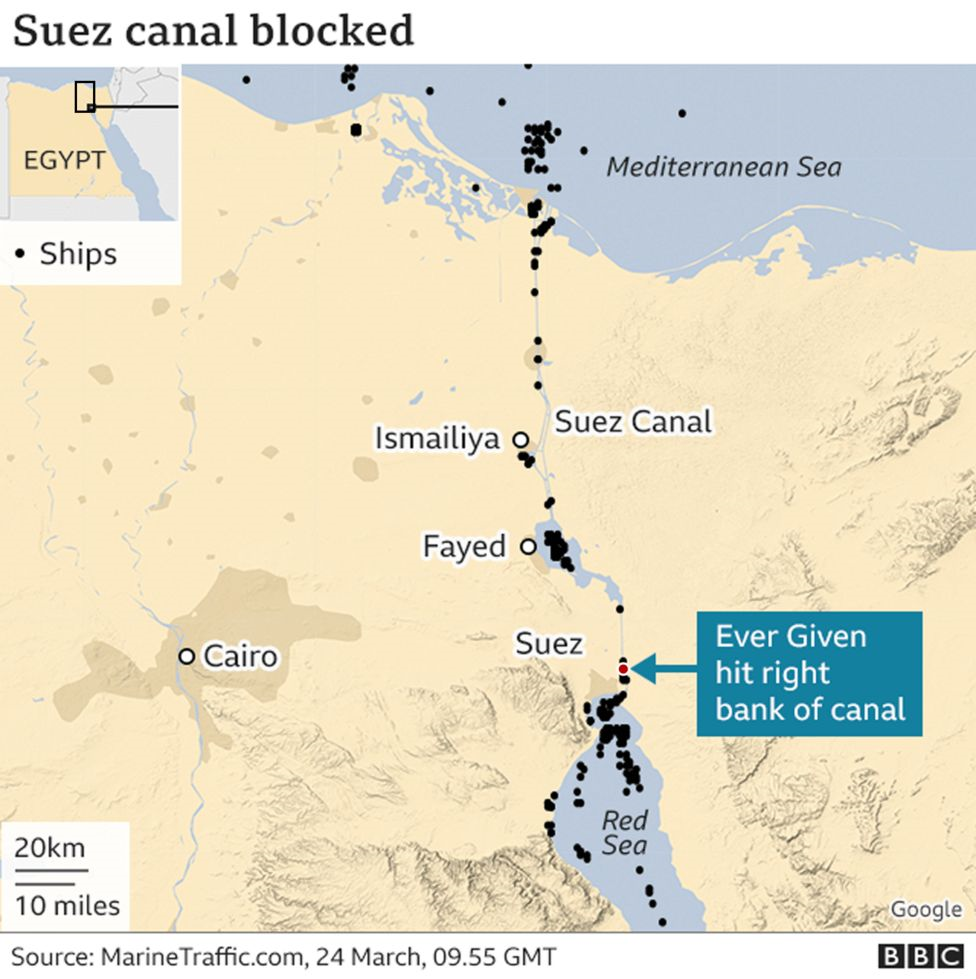

The Suez Canal is blocked by a giant container ship, Evergreen— This news has been all over the print and electronic media for the last 4 days. The business world which is slowly recovering from the pandemic is in a state of panic after this incident. Experts estimate the losses to be in billions of dollars for insurers and the loss of trade per day due to the blockage at close to US$ 9 billion. Images show a giant vessel laden with containers (around 20,000 TEUs) hitting the right bank of the canal, going off-course and getting stranded, blocking both the north-south & south-north lanes of the canal, bringing traffic to a halt.

Before we attempt to unravel the types of losses this incident will throw up, who will pay for these losses and how soon will the salvaging operations to re-float the vessel succeed, we need to understand why the Suez Canal is so critical to world trade. First things first, many are under the impression that the name of the stranded vessel is Evergreen. No, Evergreen Marine is the name of the Taiwanese firm which operates the vessel. The name of the ill-fated vessel is EVER GIVEN, built in 2018 and owned by a Japanese company. She was on a voyage from China to Rotterdam.

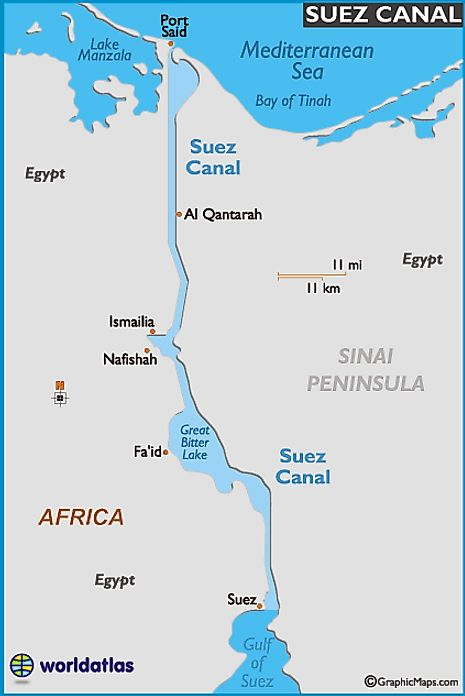

The Suez Canal, one of the most important shipping lanes in the world is man-made or an artificial waterway connecting the Red Sea with the Mediterranean Sea. It provides the shortest sea-route from the Atlantic to the Indian Ocean, or to put it differently … from Europe, North America to Asia & vice-versa. What if the canal was not there as was the case before 1869? Vessels on the Asia-Europe-North America route had to go round the Cape of Good Hope, past the west coast of Africa resulting in a longer distance and duration of voyage. To put matters in perspective, the distance from Singapore to Rotterdam going round the Cape of Good Hope is around 11755 nautical miles while through the Suez Canal it would be 8300 nautical miles. The canal is around 193 kilometers long, has 8 bends, some lakes, by-passes or loop lanes to hold vessels coming from the opposite side, since the maximum width of the canal is 225 meters only. As vessels up to DWT 240,000 are allowed through the canal, navigational support, periodical dredging and general maintenance and security of the waters and the banks become necessary. This responsibility is taken care of by the Suez Canal Authority (SCA), which is now owned by the Egyptian government. The Suez Canal separates Africa & Asia and runs from Port Suez at the Red Sea end to Port Said at the Mediterranean end.

The SCA collects tolls from vessels using the canal and the rates depend on the size of the vessel, number of TEUs on board, loaded or empty and many other parameters. A vessel like the Ever Given carrying 20,000 TEUs has to pay a toll of around US $ 700,000. Certainly not cheap. Vessels move in convoys which are created and monitored by the SCA. Typically three convoys move in a day, both north-south & south-north put together. Time taken for a vessel to traverse the entire length of the canal is between 16-18 hours. As per last count, 19,000 vessels used the canal during a year.

Today is the fifth day since Ever Given got stranded and blocked the canal. Over two hundred vessels are delayed by this enormous sea-traffic jam. Some vessels are in various parts of the canal while others are waiting to enter from the Mediterranean side and the Red Sea side. Economic losses are going to be immense. Estimates say that cargo valued at around US$ 9 billion pass through the canal daily. If the blockage is not addressed quickly, one can well imagine the compounding effect each passing day will have on supply chains round the world. Crude oil & petroleum products from the Middle-east to Europe pass through Suez Canal and if the tankers are stuck, the enormity of the problem in every sphere of economic activity will be apparent. That’s not all, China, India, Vietnam, Taiwan and other Asian countries are large exporters of cargo ranging from electronics, electronic parts, textiles, etc. to European nations & beyond mainly through the Suez Canal. Asian nations where economic activity has bounced back ( after last years’ lockdowns) far quicker than in North America or Europe, are already facing an enormous issue – Shortage of box containers. Only 40% of the containers which went to North America last year have come back. Why? There is no cargo which can be sent to Asia and sending back empty boxes is not a viable option. Now, this delay in the Suez Canal will add further days of delay and aggravate the ‘container shortage’ problem. (Refer my post Oh………for a box! ).

Insurance industry is waiting with bated breath at the direction from which claims can arise out of this canal blockage and of course what could be the enormity of the exposure. A few areas where claims are sure to come in are:

- Already salvors have been appointed and salvaging of the vessel Ever Given is underway. Dredging and use of multiple tugs is underway in a bid to re-float the vessel. There is every possibility that some of the cargo may have to be offloaded to lighten the vessel. Hence declaration of General Average and demand for GA & Salvage guarantee from cargo interests is a certainty. No cargo is said to have been damaged or lost as of now.

- The Hull & machinery also would have been damaged and there could be claims under the H & M policy too.

- Since the vessel had damaged the bank of the canal, there could be claim for damages against the vessel by the Suez Canal Authority, which has to be paid for by the vessel’s P & I Club.

- The SCA may also claim (subject to the Time deductible) for Business Interruption losses under their policy , which would be in the nature of a package policy covering their assets, liabilities & business interruption arising out of specified incidents/caused by specific perils.

- The SCA may be at the receiving end too of liability claims from the various vessels which had paid hefty tolls but still are stuck due to the canal blockage. As close to 200 vessels are stuck, this liability may be quite substantial. In turn, SCA will attempt to recoup these losses from the P & I Club of the stranded vessel. It can be long-drawn battles with regards to admissibility, quantum and available policy limits.

- Perishable cargo could face issues, as cargo insurers will read out the Delay exclusion and decline liability. Possibly such cargo liabilities will also be lodged against the SCA.

- As for the charterers, unless they had built into their charterparties something on ‘Delay’, at least ‘due to specified circumstances’, they have to continue to pay hire charges as the vessel continues to be on hire. This may vary from one vessel to another.

- There could be cancellation of certain orders of the cargo in any of the vessels which are stuck and this will not be payable under cargo insurance. The claims may then be lodged by the cargo interests on the vessel/ SCA.

Interesting days ahead – Loss adjustors, Average adjustors and maritime lawyers will have their hands full. Strangely, no cargo loss, no major H & M loss, yet the losses to the insurance industry from the EVER GIVEN incident is likely to be enormous.

Is India likely to be impacted? As of now, the impact of this incident will be minimal but if the blockage continues for days/weeks, pressure could mount for certain industries who depend on Europe & USA for critical raw materials/parts or for those industries whose turnovers are driven by exports to these countries. Further, once the blockage is removed, it may still take at least a week for all the piled-up vessels to pass through the canal. Some vessels bound for India are among them and it is expected that there could be pressure for a while on the Indian ports on the west coast as many of these vessels may seek berthing together/in rapid succession. The Indian government has already chalked out a broad action plan which includes re-routing of some vessels round the Cape of Good Hope, focus on perishable cargo & honouring existing freight rates.

A once-in-a- lifetime type of event this. A vessel which had neither sunk nor lost any cargo overboard or herself suffered serious damage, yet the losses to insurers could be substantial without counting the consequential economic losses. Is there a parallel to Covid-19 which by itself does not cause damage to cargo but the attendant lockdowns & restrictions did, mostly consequential in nature? A wake-up call for the whole world.

Discover more from BalasBroadcast

Subscribe to get the latest posts sent to your email.

Truly an event we are all watching closely. GA will not stand scrutiny as there is no imminent danger to the voyage and experts have ruled out off loading of containers which would take months. Let us hope they are able to free the canal and let shipping happen smoothly as soon as possible. Economic loss to the world at large will be huge….and is mounting by the day.

As usual a beautiful overview of the situation, the canal, the possible impact and insurance angle…. always a pleasure to read your free flowing blogs.

GA may be contested but the salvaging charges are not going to come cheap and contribution from all interests will be expected. It is also to be seen how much damage has the vessel suffered and if she can continue the voyage to Rotterdam. In all probability she will be taken to the nearest port, Suez ( if draft permits) and then decision taken on the cargo.

Very nice read , clearly puts out all the expected losses and the policies that would respond to those losses.

Really a nice read. Let’s wait and watch how much will be the actual impact on Insurance industry…

Very lucid and comprehensive assessment, Bala

ThanQ

Dear mr. Bala

Your clear analysis of various issues linked to this Ever Given standing is brilliant.

For any practitioner or student of marine insurance this is an eye opener. A case of one single accident causing an avalanche of claims. This one is a classic case study in recent times. Hats off to you Bala sir. Keep us informed. Thanks again

ThanQ

Very Nice Blog!!!!! 6:39 PM Join other followers on our blog…

Excellent, and lucid. Thanks, Bala